Insurer Knowledge Graph

Ground up design and build of an insurer knowledge graph. Combined the output of an entity resolution engine with the rich semantic relationships present in insurers' data to create a highly intuitive graph and front-end for fraud detection. Demonstrated ad-hoc investigations and feature engineering could be made several orders of magnitude quicker. Tests were conducted for a tier 1 insurer with 3 years of historic data resulting in a graph of c. 300m nodes and relationships. The following sections illustrate some of the key benefits.

Technologies used: neo4j, React, Keylines, node.js

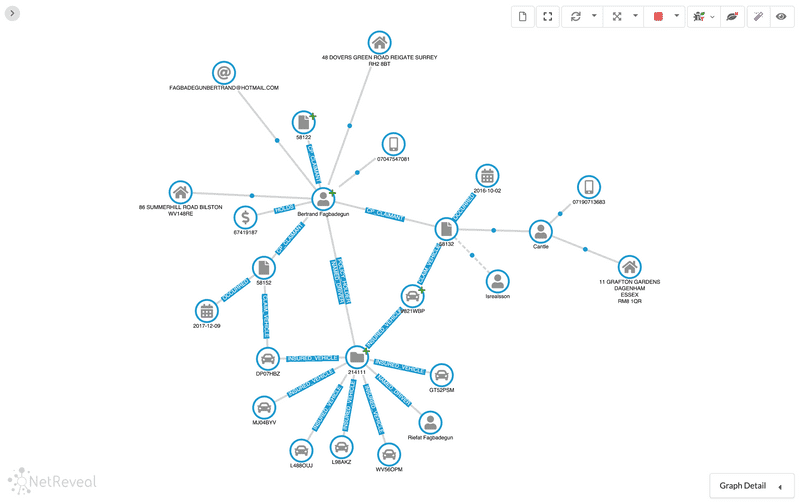

Semantic Graph Schema

Modelling an insurer's data the way fraud investigators think about insurance - claims and policies, the parties involved, their personal attributes (addresses, phone numbers...) and how these are linked.

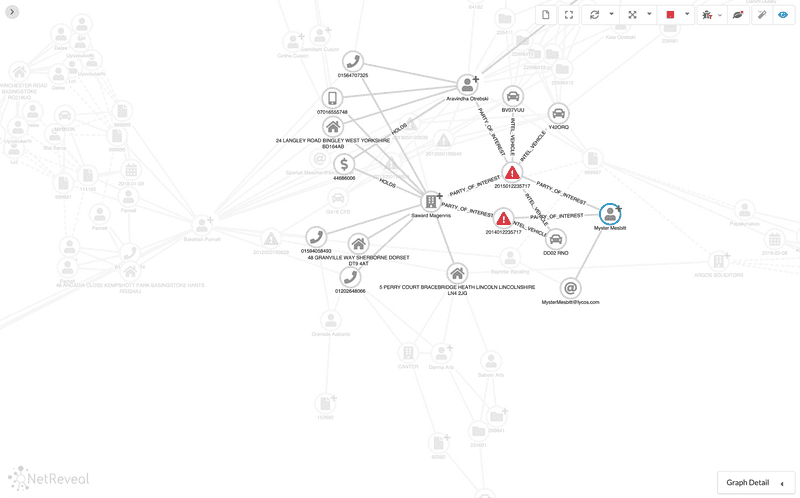

Traceability

The graph provides full traceability of which nodes were derived from which documentary sources. The foreground in the illustration below shows a party of interest ('Myster Mesbitt'), the intelligence documents he is referenced in (represented by red warning triangles) and the other entities referenced in those intelligence documents. The background shows the other entities these in turn link to.

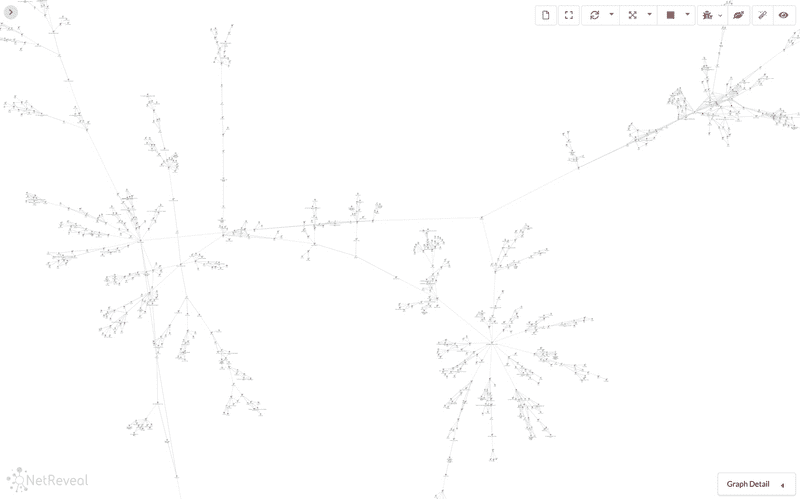

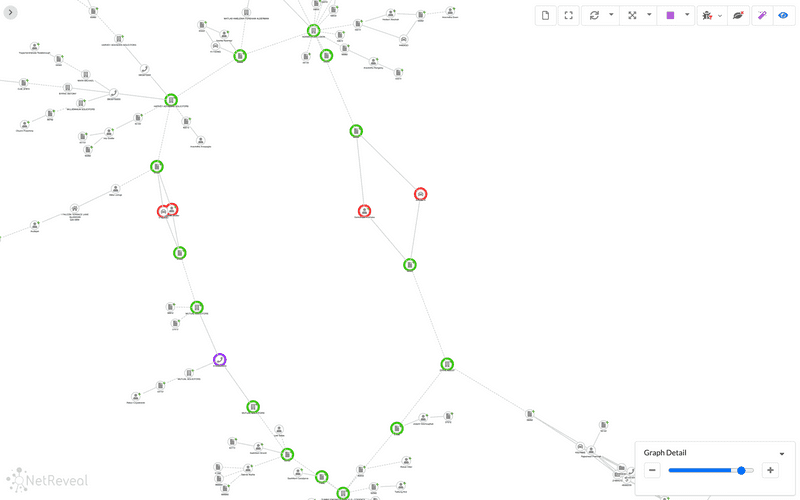

Exploration of large communities

Parts of the graph associated with organised fraud rings can be complex to investigate when reviewing the full detail of the underlying graph...

... a 'Graph Detail' slider underpinned by graph measures such as centrality/connectedness as well as domain specific knowledge can be used to dial-back detail or progressively reveal more information. This allows investigators to focus on the most relevant parts of the graph. The below illustrates simplication of the key connections in a community, showing primarily how people and businesses link via the claims they make.

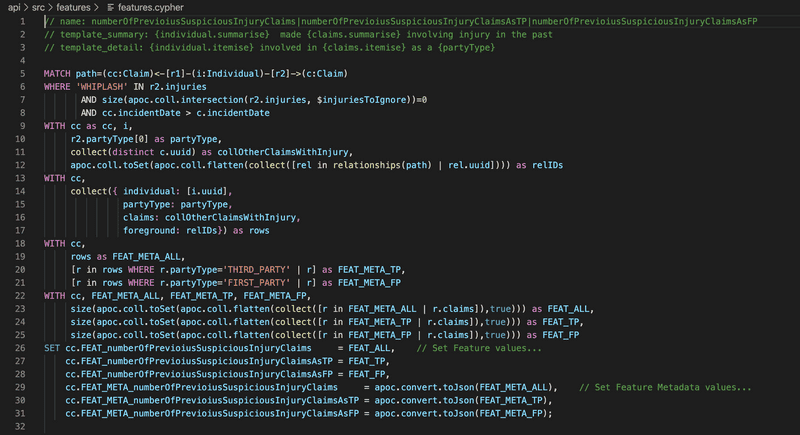

Features definition with template-driven descriptions

Cypher configuration files with a description template structure allow configurers to express graph patterns to be matched along with powerful templates that express the conextual findings of those patterns in plain text.

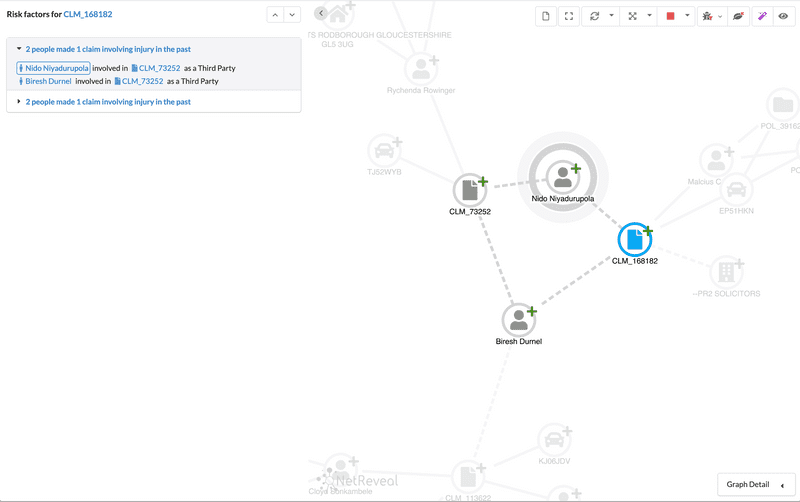

This allows investigators to review plain text descriptions of the risk, along with the context of the matched patterns in the graph.

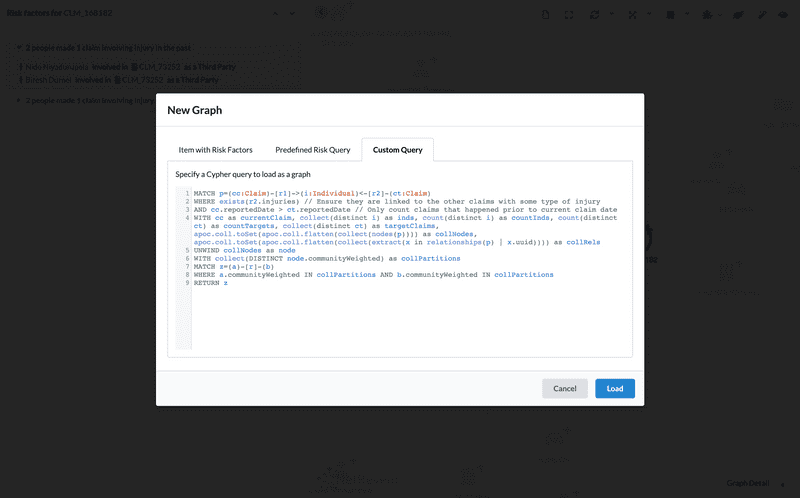

Ad-hoc investigation

Advanced users can expore patterns of interest in the full graph using Cypher queries.

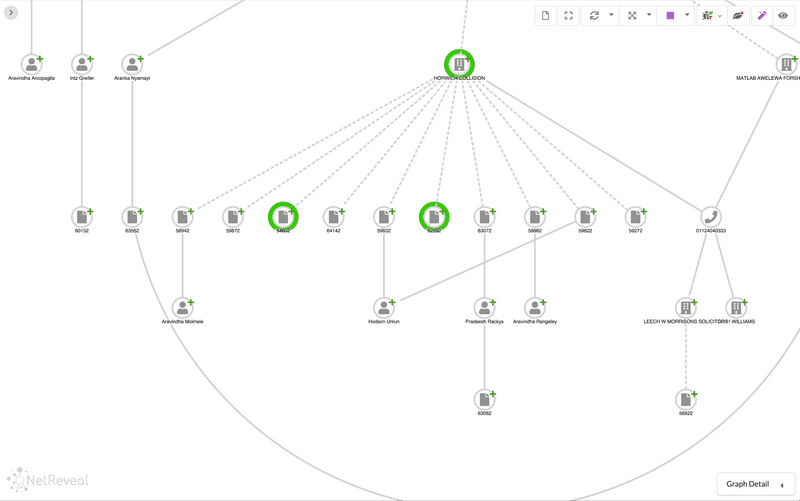

Alternative layouts

A range of different layouts provide more ways for investigators to review fraud, such as hierarchical supplier centric views of claims and the parties involved.